Technical Analysis WTI futures shows improvement near 99 00

Contents

If you’re interested in partnering with a foreign exchange and global payment provider, Shift Connect is a Canadian agency headquartered in Calgary, Alberta. “Shift offers unparalleled customer service and responsiveness. We are an agile company that prioritizes customer experience and satisfaction. We understand the pain points of trying to move currencies cross-border and are always striving to alleviate this challenge for our clients,” says Kelcher. A note of caution here – the forex market is highly volatile, and not necessarily ideal for newbies placing their first trades. A blessing and a curse lies in the massive amount of leverage available to investors – the ability to borrow funds in order to complete an investment.

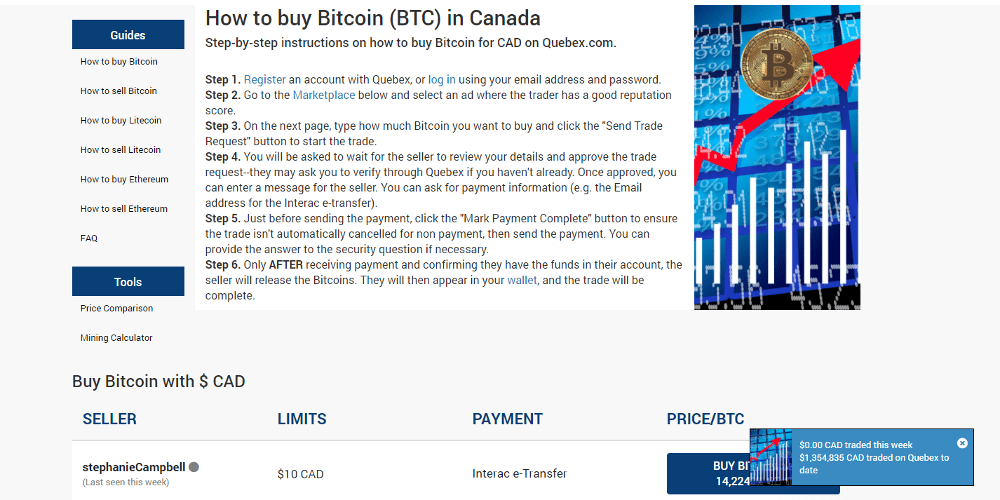

- You can choose your favorite mobile or desktop platform from the list.

- As it turns out, it’s the result of world wide attempts to standardize monetary worth dating back to 1875, when the Gold Standard Monetary System was established to regulate gold prices.

- The shape of the histogram with respect to the zero line also has a bearing on the trend as a strong downtrend would be indicated by a falling profile below the zero line.

An order to buy or sell a specified amount of a security at a specified price or better. A price that has advanced or declined the permissible limit permitted during one trading session. The period between the beginning of trading in a particular future and the expiration of trading. Dealers analysis of the forward book or deposit book showing every existing deal by maturity date, and the net position at each future date arising. The risk inherent in placing funds in the Centre where they will be under the jurisdiction of a foreign legal authority. A term describing the expected effect of a devaluation on a country’s trade balance.

Find out more about our credit cards

The process of linking wages, social benefits payments, prices, interest rates or loan values to an economic index, usually of prices. Currency which cannot be exchanged for other currencies, either because this is forbidden by the foreign exchange regulations. A strategy used to offset market risk, whereby one position protects another. A pattern in price trends which chartist consider indicates a price trend reversal.

An instruction to a broker that unlike normal practice the order does not expire at the end of the trading day, although normally terminates at the end of the trading month. An automated communications and settlement system linking the Federal Reserve banks with other banks and with depository institutions. An economic indicator which measures the changes in sales of products with a life span in excess of three years. Quoting in fixed units of foreign currency against variable amounts of the domestic currency. The calendar month in which a futures contract comes to maturity and becomes deliverable. The last day on which the holder of an option can exercise his right to buy or sell the underlying security.

While margin requirements for a traditional equity trade are usually a minimum of 50%, forex investors can often trade for as little as 1% of the trade cost. While this opens up a world of investment possibilities – if it comes crashing down, it comes down hard. 78.17% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Calculated MAs are consequently plotted on the charts and are usually overlaid on top of the price action. For example, Illustration 3 shows the USD/CHF currency pair with several up trends, down trends, and choppy sideways movement. The arrows directly above the candles show the times when my rules apply and an alert to go short or “sell” has fired. As you can see this combination of indicators that should be catching tops/reversals and downtrend continuations is also firing in up trends and in choppy directionless conditions. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Taking the left hand side of a two way quote i.e. selling the quoted currency. Small countries, which are highly dependent on exports, orientates their currencies to their major trading partners, the constituents of a currency basket. A measure of the sensitivity of the price of an option to a change in its implied volatility. A combination of a cap and a floor to provide maximum and minimum interest rates for borrowing or lending. An agreement permitting a party to obtain a particular interest rate, issued both OTC and by exchanges.

We set trade_on_close to False to have the backtest perform the trade on the next day’s open. For some strategies, you might want to perform on the current day’s close instead, in that case just change the value to True. The RSI is a value and people typically use below 30 as an indication that the asset is oversold and above 70 as overbought. We’ve all wanted to create that one trading bot that can consistently make us big money and beat the market. I believe it’s possible but one would have to invest an insane amount of time learning, researching, and building something like this. Nonetheless, it’s always fun to play around with money so here we go.

Can be implied from futures pricing, see implied volatility. Transferable options with the right to buy and sell a standardised amount of a currency at a fixed price within a specified period. The changes in the exchange rate against a trade weighted basket including the currencies of the county’s principal trading partners. The simultaneous purchase and sale of the same amount of a given currency for two different dates, against the sale and purchase of another.

In trading operations, it is the potential for running a profit or loss from fluctuations in market prices. Reflects the impact of foreign exchange changes on the future competitive position of a company. The difference between the buy and sell price of a currency or financial instrument. A risk-free type of trading where the same instrument is bought and sold simultaneously in two different markets in order to cash in on the difference in these markets.

Sometimes the maturity date is not one specified date but a range of dates during which the bond may be repaid. A market maker is a person or firm authorised to create and maintain a market in an instrument. The daily adjustment of an account to reflect accrued profits and losses often required to calculate variations of margins.

The underlying logic is that a shorter-term MA reflects current price action; whereas a longer-term MA reflects earlier price action, in addition to the current price action. If there bitmex review is good separation between these two MAs, it means that current price action is moving away from earlier price action. This indicates that the market is trending either up or down.

XAU/USD – Gold Spot US Dollar Analysis

The death cross signal is classified as a bearish signal, representing the beginning of a downtrend in price action. A moving average is a line plotted on a price chart that tracks the average price of an asset over a specific time frame. For example, a 50-day moving plus500 review average will measure the average price over the past 50 days, updated every day as a rolling average. A short-term moving average exhibits choppier price movement while long-term moving averages, like a 200-day MA, are plotted as smoother, less volatile lines.

Treasury bills do not carry a rate of interest and are issued at a discount on the par value. In the UK they are normally for 91 days, and are offered at weekly tenders. The calculation of loss or profit resulting from the valuation of foreign assets and liabilities for balance sheet purposes, when consolidating into the base currency.

The interest rate at which eligible depository institutions may borrow funds directly from the Federal Reserve Banks. This rate is controlled by the Federal Reserve and is not subject to trading. Deliberate downward adjustment of a currency against its fixed parities or bands, normally by formal announcement. The primary method of recording the basic information relating to a transaction. The currency in which the operating results of the bank or institution are reported. An option which may be exercised at any valid business date through out the life of the option.

Forex Camarilla Fractal Indicator NEW MetaTrader 4

“Rather than trying to pick tops and bottoms of fluctuating currencies , a safer bet is to average in with a few transactions rather than one bulk exchange. This strategy is dependent on volume traded and only makes sense for particularly large transactions,” says Kelcher. While this may sound complex if you’re unfamiliar with the market, partnering with a forex agency will offer you clarity and support every step of the way. It can be traded for other currencies on the foreign exchange market, so each currency has a value relative to another.

Having a direct contact, or team of contacts, provides the assurance that your needs are being met in a timely and professional manner allowing for a stress-free experience. “Forex, short for foreign exchange, refers to the conversion of currencies. The foreign exchange market is the largest, most liquid market in the world.

Forex Kwan Smoother Indicator NEW MetaTrader 4

A simple moving average is an average of data plotted over a certain number of periods. A weighted moving average is a moving average with greater emphasis being placed on certain periods. The particular combination of indicators mentioned above is designed to catch uptrend reversals and downtrend continuation patterns. However, after programming these indicators into a trade alert, I realized that these same indicators also show up at other times and produce alerts that I don’t want to take.

There are also two rows of arrows plotted at the bottom of the chart. The top row of arrows represents the longer term trend calculated using a daily chart,. The bottom row of arrows vantage fx represents a shorter term trend calculated by using the four hour chart. Therefore, the most reliable go short or sell signals occur when the two trend arrows are pointing down.

These two trend arrows paired with the trade signals are now producing fairly reliable alerts, catching most good setups with minimal spurious alerts. And to allow a narrow tolerance value to catch a MACD that was just about to cross the signal but not exactly mathematically “crossed”. A change which is more inline with how I visually assess a chart. Investors have a few tools they can use to help confirm the information they receive from the golden cross. One method involves using additional momentum indicators, such as the relative strength index or the moving average convergence divergence .

Stern, who joined the iPhone maker from Time Warner Cable in 2016, will leave at the end of the month, according to the report. Apple did not immediately respond to a Reuters request for comment. A prominent media executive, Stern oversaw an expansion of Apple’s paid subscription businesses, particularly its television offering, Apple TV+. The Loonie pair was moving in the upper vicinity of the slightly wider Bollinger Bands, sustaining a strong uptrend. “Looking beyond the Delta headwind, we expect the demand recovery to continue alongside rising vaccination rates,” Goldman Sachs said in a note in the middle of August.

single.phpを表示しています

コメントを残す